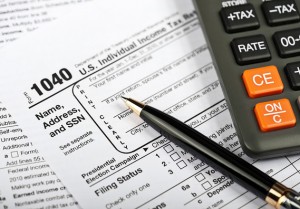

Now is a good time for you to do a mid-year health check on your record keeping and tax status.

Now is a good time for you to do a mid-year health check on your record keeping and tax status.

Give us a call at 619-589-8680 and let’s set up a time for you to come in.

June 2, 2014

Deadline for financial institutions to send out Form 5498 to report balances in an individual retirement account for the year 2013.

June 16, 2014

2nd quarter estimated tax payments due for the 2014 tax year. (The normal deadline is June 15th, which falls on a Sunday, so the deadline is pushed to the next business day.)

Deadline for US citizens living abroad to file individual tax returns and to pay any tax due. You can request an additional 4-month extension (Form 4868). (You can request an automatic extension by April 15th instead if you want to.) Two tax breaks important for Americans working abroad are the Foreign Earned Income Exclusion and the Foreign Tax Credit, .

June 30, 2014

Deadline to file Foreign Bank Account Report for the year 2013. This report is required if you have over $10,000 (in aggregate) held in foreign bank accounts. Foreign Bank Account Reports have a new form number (FinCEN Form 114) and must be filed electronically. Extensions of time to file are not available.

September 15, 2014

3rd quarter estimated tax payments due for the 2014 tax year.

Final deadline to file corporate tax returns for the year 2013 if an extension was requested. (Forms 1120, 1120A, 1120S).

Final deadline to file trust income tax returns (Form 1041) for the year 2013 if an extension was requested.

Final deadline to file partnership tax returns (Form 1065) for the year 2013 if an extension was requested.

October 1, 2014

Final deadline for self-employed persons or small employers to establish a SIMPLE-IRA for the year 2014.

October 15, 2014

Final deadline to file individual tax returns (with extension). (Forms 1040, 1040A, 1040EZ.)

Last day the IRS will accept an electronically filed tax return for the year 2013. If filing after October 15th, you’ll need to mail in your tax return for processing.

Final deadline to fund a SEP-IRA or solo 401(k) for tax year 2013 if you requested an automatic extension of time to file.

November 2014

Start planning any year-end tax moves.

December 1, 2014

If you are covered by an HSA-compatible health insurance policy as of December 1st, you’ll be eligible to contribute the full amount to a Health Savings Account for the year.

December 31, 2014

Last day to make any tax moves for the year 2014. Last day to set up a solo 401(k) for self-employed persons.

Marital status on this date determines your marital status for the whole year.

Source: Income Tax Deadlines; Critical IRS Deadlines in the Year 2014

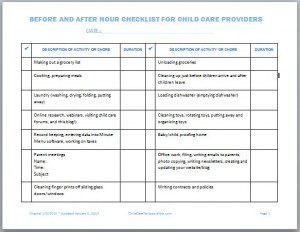

We always meet with our new child care provider clients to check their past deductions because many times they have not properly depreciated the day-to-day materials, furniture, and household items they use in the daily operation of their business.

We always meet with our new child care provider clients to check their past deductions because many times they have not properly depreciated the day-to-day materials, furniture, and household items they use in the daily operation of their business.

Publication 587 – Business Use of Your Home

Publication 587 – Business Use of Your Home